Binance (BNB) Blockchain

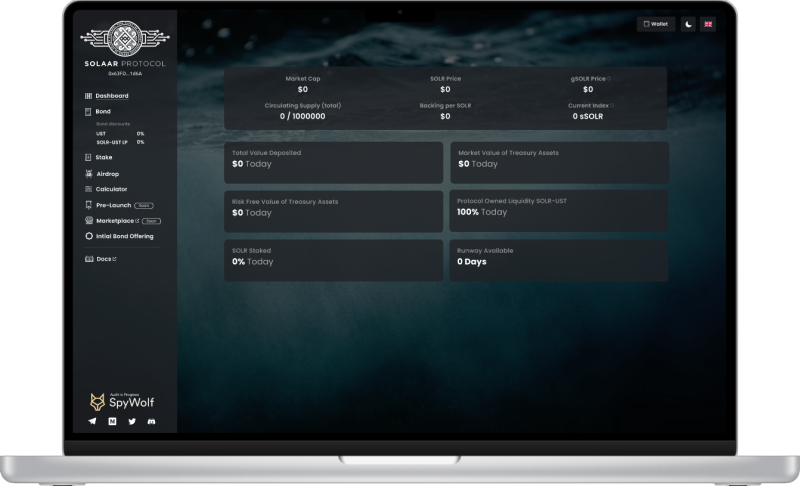

SOLLAR Protocol

What is SOLAAR Protocol?

SOLAAR Protocol is a decentralized reserve coin protocol on the Binance blockchain based on the $SOLAAR token. Each $SOLAAR token will be backed by a basket of assets (e.g. BUSD, BNB, BTC) and LP tokens in the SOLAAR treasury, giving it an intrinsic value that provides a foundation of value. SOLAAR Protocol also introduces economic and game-theoretic dynamics into the market through staking and bonds.

SOLAAR Protocol is based on the code of OlympusDAO and it is built on the Binance blockchain [BSC], however- we have major differences and are evolving at a rapid speed through innovation and adaptation.

Feel free to read the Medium article "Introduction to SOLAAR Protocol".

What is objective of SOLAAR Protocol?

Most DAO coins do not have any tokenomics built-in internally. Investors can suffer from high volatility and the coin has a significant chance to head towards zero value. SOLAAR developers noticed that the OlympusDAO had created strong and fast growing tokenomics in the DeFi world. We decided to bring the bonding and protocol-owned liquidity to the SOLAAR Kingdom!

Our goal is to build a policy-controlled DAO coin system, in which the behavior of the SOLAAR token is controlled at a high level by the DAO. In the long term, we believe this system can be used to optimize for stability and consistency so that $SOLAAR can function as a global unit-of-account and medium-of-exchange DAO coin. In the short term, we intend to optimize the system for growth and wealth creation (stacking BTC).

Excess treasury reserves are to be airdropped to our stakers as well as BTC produced by Bitcoin mining operations (in the future).

How do I join the SOLAAR System?

There are two main ways for SOLAAR members to participate: staking and bonding. Stakers stake their $SOLAAR tokens to Solaarians in return for more $SOLAAR tokens, while bonders provide LP or UST tokens in exchange for discounted $SOLAAR tokens after a fixed vesting period.

Staking

All you have to do is hold.

Staking is the primary value accrual strategy of SOLAAR Protocol.

Stakers vest their $SOLAAR through the SOLAAR Protocol Dapp in order to earn rebase rewards. The rebase rewards come from the proceeds from bond sales, and can vary based on the number of $SOLAAR staked in the protocol and the reward rate set by monetary policy.

Staking is a passive, long-term strategy.

The increase in your stake of $SOLAAR translates into a constantly falling cost basis converging on zero. If the market price of $SOLAAR drops below your initial purchase price, the increase in your staked $SOLAAR balance should eventually outpace the fall in price, given a long enough staking period.

When you stake, you lock up $SOLAAR and receive an equal amount of sSOLAAR.

Your sSOLAAR balance rebases up automatically at the end of every epoch. sSOLAAR is transferable-and therefore composable with other DeFi protocols.

When you unstake, you burn sSOLAAR and receive an equal amount of $SOLAAR

Unstaking means that the user will forfeit the upcoming rebase reward. Note that the forfeited reward is only applicable to the unstaked amount; the remaining staked $SOLAAR (if any) will continue to receive rebase rewards.

NFT Bonds

Bonding is the secondary value accrual strategy of SOLAAR Protocol.

Bonding enables SOLAAR Protocol to acquire its own liquidity and other reserve assets such as UST by selling $SOLAAR to investors at a discount in exchange for these assets. The protocol quotes the bonder with terms such as the bond price, the amount of $SOLAAR tokens entitled to the bonder, and the vesting term. The bonder can claim some of the rewards (SOLAAR tokens) as they vest, and at the end of the vesting term, the full amount will be claimable.

Minting SOLAAR Bonds is an active, short to medium term strategy.

The price discovery mechanism of the secondary bond market renders bond discounts more or less unpredictable. Therefore, bonding is considered to be an active investment strategy that should be monitored constantly in order to minimize risk, as compared to staking.

The vestment distribution of a bond is placed in your staking balance for rebasing. (4,4)

Minting Bonds allows SOLAAR Protocol to accumulate its own liquidity.

We call our own liquidity POL: Protocol Owned Liquidity. More POL ensures there is always locked exit liquidity in our trading pools to facilitate market operations and protect token holders. Since SOLAAR Protocol becomes its own market, on top of additional certainty for $SOLAAR investors, the protocol accrues more and more revenue from LP rewards bolstering our treasury.

Primary Strategies

Bitcoin: There is no second best!

Our underlying investment strategy is to simply stack Bitcoin. We will do this by various means such as directly purchasing spot BTC, mining BTC and deploying BTC into any solid programs that yield BTC. This will allow our treasury and our users to benefit from price increases in BTC faster than just buying it themselves.

UST: Decentralized Stablecoin (This strategy is being re-worked, TBA)

We aim to become the largest source of UST liquidity on the Binance blockchain; and then branch out to establish liquidity on other chains such as FTM, MATIC and AVAX. UST, along with BTC will be the primary assets backing the $SOLAAR token. UST and pairs UST-BTCB, UST-BNB, UST-BUSD will be raised by selling NFT bonds. UST based staking and farming also be offered with a focus on stablecoin farming.

Nodes

One of our major rollouts will be our node system that will reward in stablecoin yields. Details to be disclosed upon launch. Nodes as NFTs; transferrable and open to resell on secondary markets.

Reserve Currency Backed by Bitcoin and LP Holdings.